Building the OS for a Climate-Resilient Global Economy

Impactree bridges physical data and financial intelligence to power Enterprise Investment Intelligence.

$140B+

Market Opportunity

$200K

Annual Revenue

$1M

Current Raise

30%

EBITDA Margin

The Information-to-Impact Gap

Legacy enterprise intelligence misses what matters — resilience. Physical and transition risks cut across operations, but go unseen in real time.

From mispriced loans, failed projects, and unmodeled climate risk in the past 5 years.

Despite rising regulatory expectations, banks still depend on spreadsheets for ESG risk.

Companies without climate resilience pay a premium in credit and insurance.

The $2 Billion Failure Story

Critical climate and ESG data remains trapped in silos, leaving enterprises blind to physical risks and unable to make informed decisions.

Real Case: Chemicals Project Failure

A major chemicals project failed due to inadequate climate risk assessment, resulting in massive delays and cost overruns that eroded investor confidence.

The Core Problem

Too much data. Too little relevant intelligence.

Data Unused

Organizations collect massive amounts of ESG data, but 90% remains unanalyzed and disconnected from decision-making

Months Lag

Critical insights arrive too late for proactive risk management and strategic decision-making

Misaligned Data

Data reaches the wrong stakeholders at the wrong time, leading to missed opportunities and poor decisions

Measurable Economic ROI

By connecting real-time resilience data to financial decision-making, we transform ESG from a compliance cost into a strategic advantage that drives profitability and risk reduction.

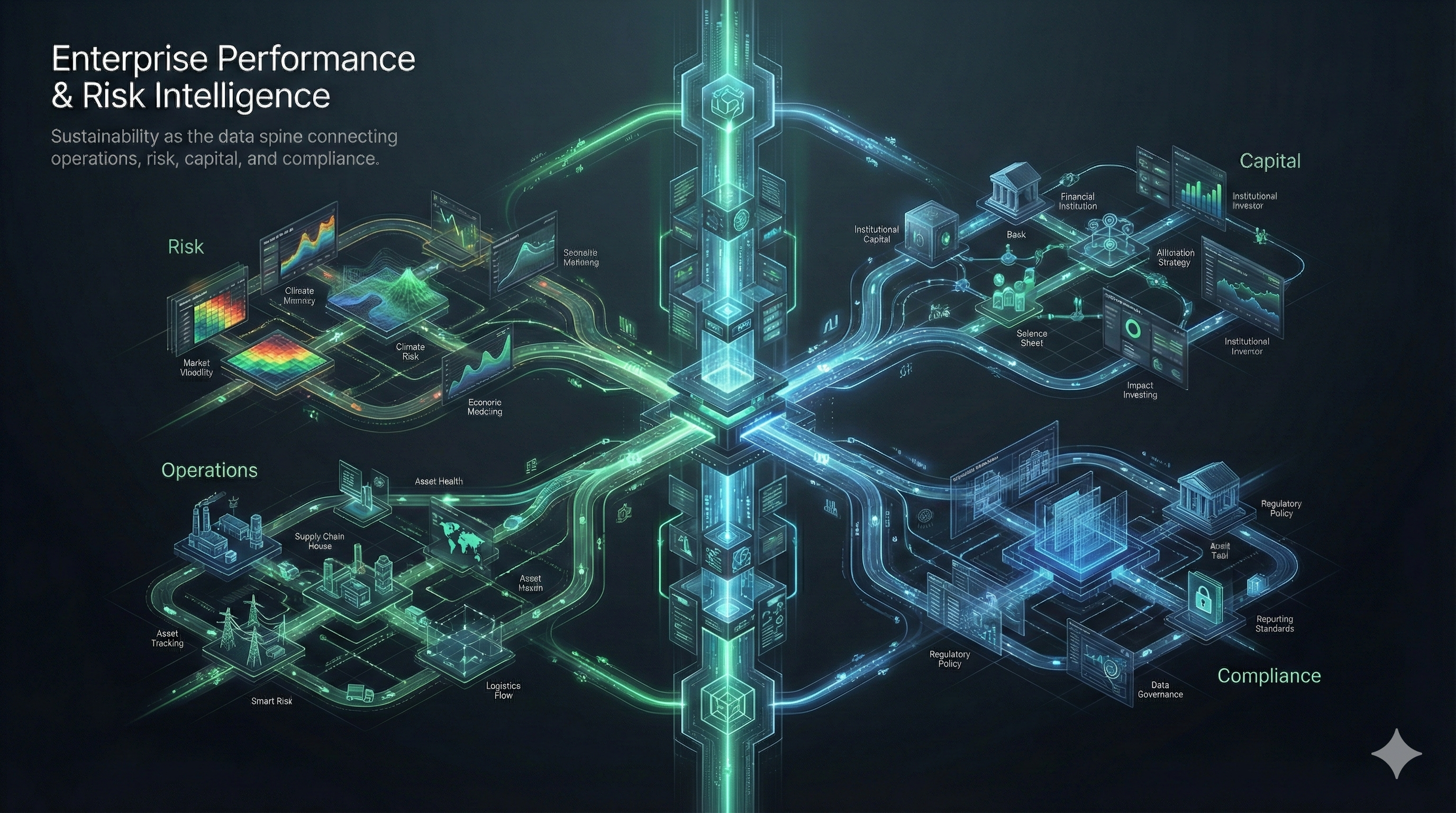

The Sustainability Lakehouse

RubiCr is the Databricks-style Lakehouse for ESG — integrating asset-level sensors and ESG logic into financial strategy.

Layer 1: Ingestion

RubiCr Argus, Zero, Valence

Layer 2: Transformation

Normalization into CO₂e, SROI, KPIs

Layer 3: Intelligence

RubiCr Caetis: Risk Modeling

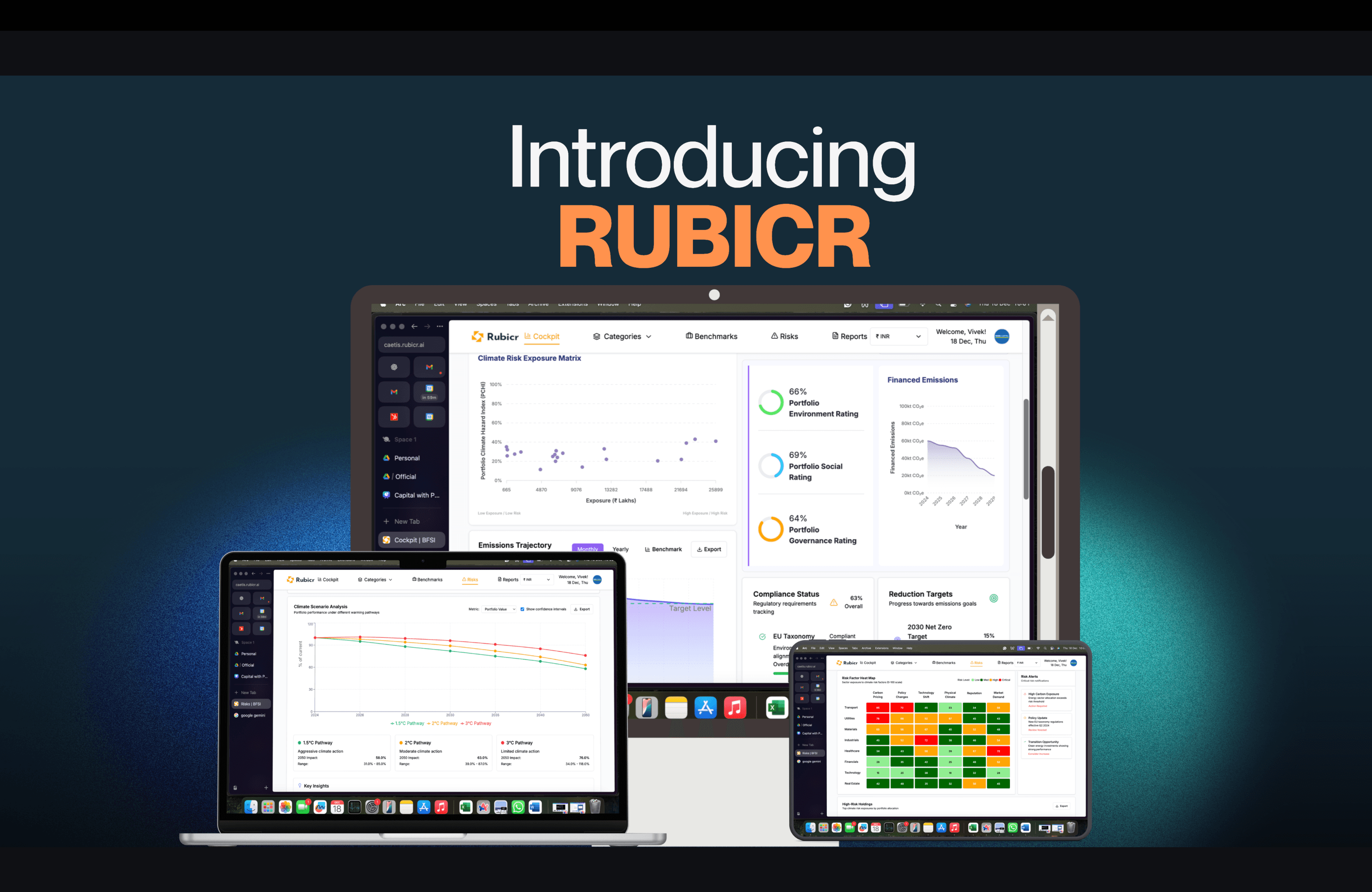

Introducing RubiCr

The OS for Enterprise

Investment Intelligence

Real-Time Analytics

Live climate risk exposure and portfolio monitoring with actionable insights

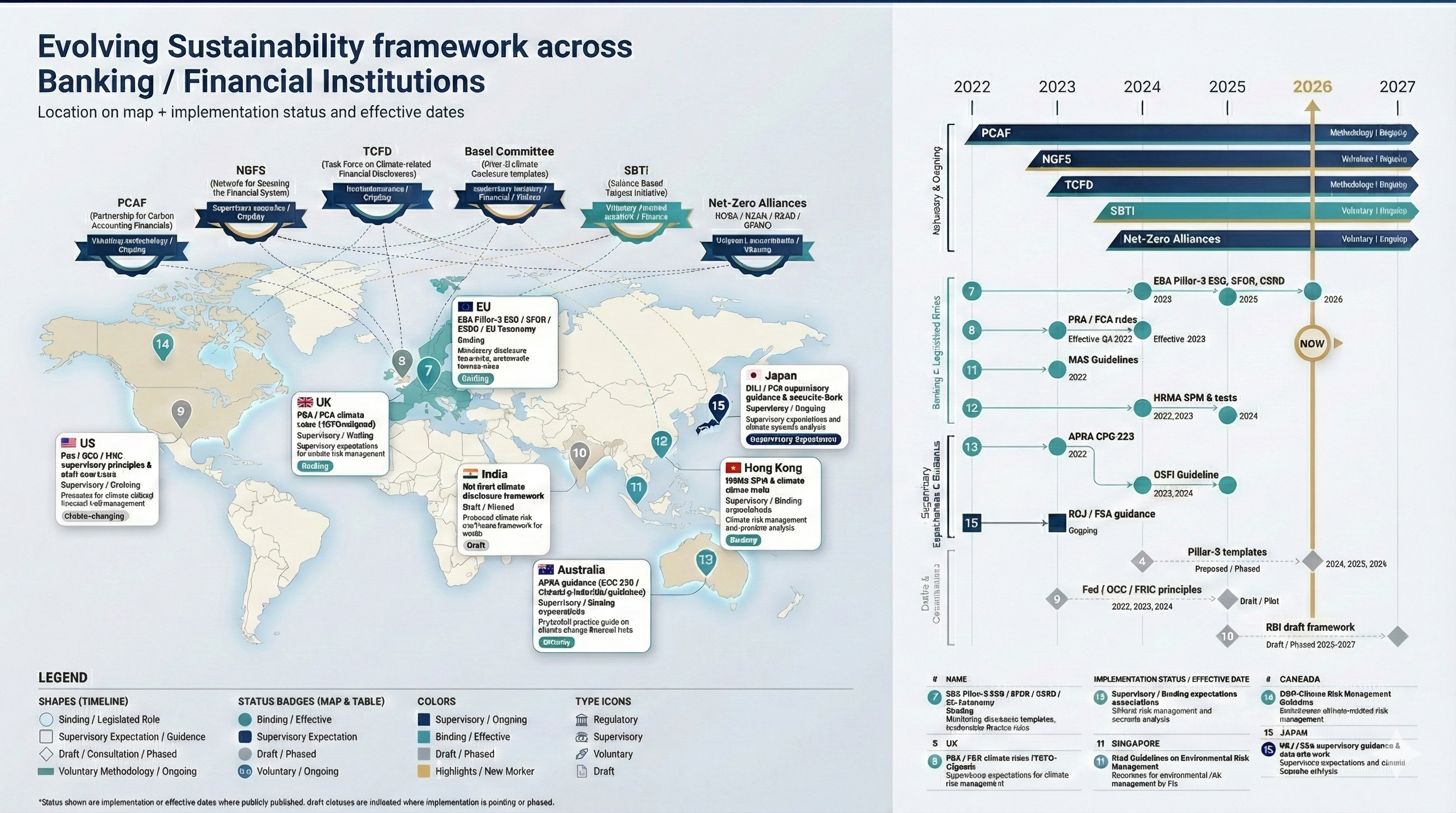

Compliance Intelligence

Automated regulatory tracking and reporting across global frameworks

Financial Integration

ESG metrics directly linked to credit risk, PD/LGD, and investment decisions

Product Ecosystem

Discover our suite of AI-powered solutions designed to transform your organization

Spotlight: RubiCr Caetis

Purpose-built for banks, Caetis turns resilience into credit-risk intelligence: scenario testing, climate-adjusted credit models, and RBI 2025 compliance.

RBI 2025

Compliant

Why Impactree Wins

We're not just another ESG software company. Our unique position bridging physical and financial worlds creates an unassailable competitive advantage.

Capability

Impactree

Watershed / Persefoni

SAP / IBM

Deep Physical Asset Monitoring

Financial Risk Intelligence

Regional Regulatory Expertise (RBI/MENA)

AI-Powered Predictive Risk

Full-Stack Context Advantage

Pre-built Industry Integrations

Total Market Size

Interactive bottom-up market analysis: Manipulate geography, product selection, and pricing to dynamically calculate Impactree's addressable market opportunity

Market Dynamics Filters

Geography Selector

Active multi-select

Pricing Tier Slider

Industry Selector

Operational Entry TAM (Bottom-up)

Serviceable enterprise segment aligned with Impactree product stack (Companies × ARPU)

SAM (Primary Regions)

SOM (5-7 yr achievable target)

Product Module Selector

Market Visualization Analytics

Product TAM Distribution (Stacked Bar)

Wallet Allocation Donut Chart

Average Enterprise ESG Stack Wallet

Trusted by Industry Leaders

Leading financial institutions and enterprises rely on RubiCr for ESG intelligence

Traction & Momentum

Proven product-market fit with enterprise clients across BFSI and industrial sectors

200+

Client Organizations

40×

Average Client ROI

$200K

Annual Recurring Revenue

<12mo

CAC Payback Period

Growth Trajectory (2018-2025)

World-Class Team

25+

Team Members

4

Office Locations

San Francisco

USA

London

UK

Singapore

SG

Mumbai

India

Founding Team

Our founding team brings deep domain expertise from leading institutions in banking, energy, and AI research. We've built products used by Fortune 500 companies and understand the unique challenges of enterprise ESG transformation.

- 15+ years combined experience in BFSI risk management

- Ex-senior roles at leading banks and energy companies

- PhDs in Climate Science, Computer Science, and Economics

- Proven track record in AI/ML and enterprise SaaS

Founder Name

Co-Founder & CEO

15+ years leading enterprise SaaS companies. Former VP at Fortune 500 financial institution. Expert in scaling B2B products and building high-performing teams.

Founder Name

Co-Founder & CTO

PhD in Computer Science with focus on AI/ML. Previously led engineering teams at leading tech companies. Published researcher in climate risk modeling.

Founder Name

Co-Founder & COO

Former operations director at global energy company. Expert in ESG compliance and regulatory frameworks. MBA from top-tier business school.

World Class Advisors

World Class Team

Our global presence spans strategic locations across Asia and the Middle East, serving clients worldwide with local expertise and international standards.

4

Global Offices

6

Client Regions

15+

Countries Served

50+

Team Members

Global Presence

Office Locations

Singapore

Regional HQ - APAC Operations

Chennai

Technology & Development Center

Mumbai

BFSI Solutions Hub

Dubai

Middle East Operations

Client Base Regions

Singapore

Financial Services & Maritime

Vietnam

Manufacturing & Supply Chain

India

BFSI & Industrial Sectors

UAE

Energy & Infrastructure

Saudi Arabia

Oil & Gas, Petrochemicals

European Union

Regulatory Compliance & ESG

The Ask

Current Ask

$2M USD

Seed Round

The Opportunity

We're raising $5M Series A to accelerate growth and capture market leadership. Projected to reach £35M ARR by end of 2026 with a clear path to profitability by Q3 2027.

With this capital, we project 3.2x revenue growth, expanding from 450 to 1,200+ customers, and achieving gross margin of 84%.

Our go-to-market efficiency continues to improve with a Magic Number of 1.4 and CAC payback of just 11 months.

Fund Utilization

Product Development

Sales & Marketing

Team Expansion

Operations & Infrastructure

12-Month Milestones

Launch v2.0

Enhanced AI capabilities

50+ Enterprise Clients

Expand market presence

$1M ARR

Revenue milestone

Investor Resources

Access comprehensive financial data, roadmaps, and schedule time with our founding team

Have Questions? Let's Connect

Submit an investor enquiry and our team will reach out within 24 hours to discuss opportunities.

Investor Enquiry

Share your details and we'll connect with you within 24 hours